Business Insurance in and around Carlsbad

Calling all small business owners of Carlsbad!

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Whether you own a a home improvement store, an art gallery, or a home cleaning service, State Farm has small business protection that can help. That way, amid all the various decisions and options, you can focus on your next steps.

Calling all small business owners of Carlsbad!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, worker’s compensation or business owners policies.

Let's review your business! Call Callie Jones today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

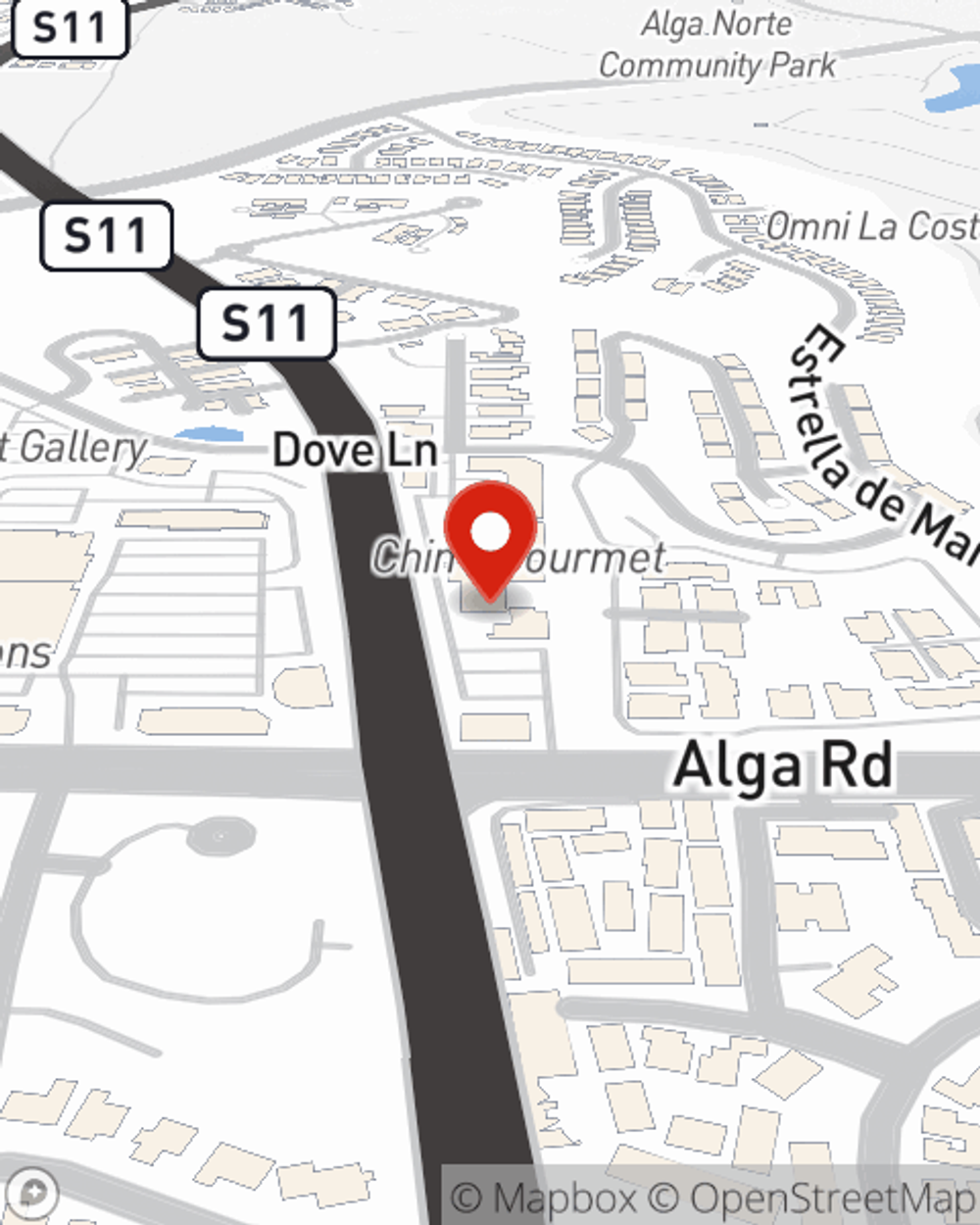

Callie Jones

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.